Arm's Length Interest Rate . Intercompany lending arrangements within multinational. An arm's length transaction is a business deal that involves parties who act independently of one another. How does the ‘arm’s length’ test work in intercompany lending? When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent.

from bpfund.com

How does the ‘arm’s length’ test work in intercompany lending? Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. Intercompany lending arrangements within multinational. An arm's length transaction is a business deal that involves parties who act independently of one another.

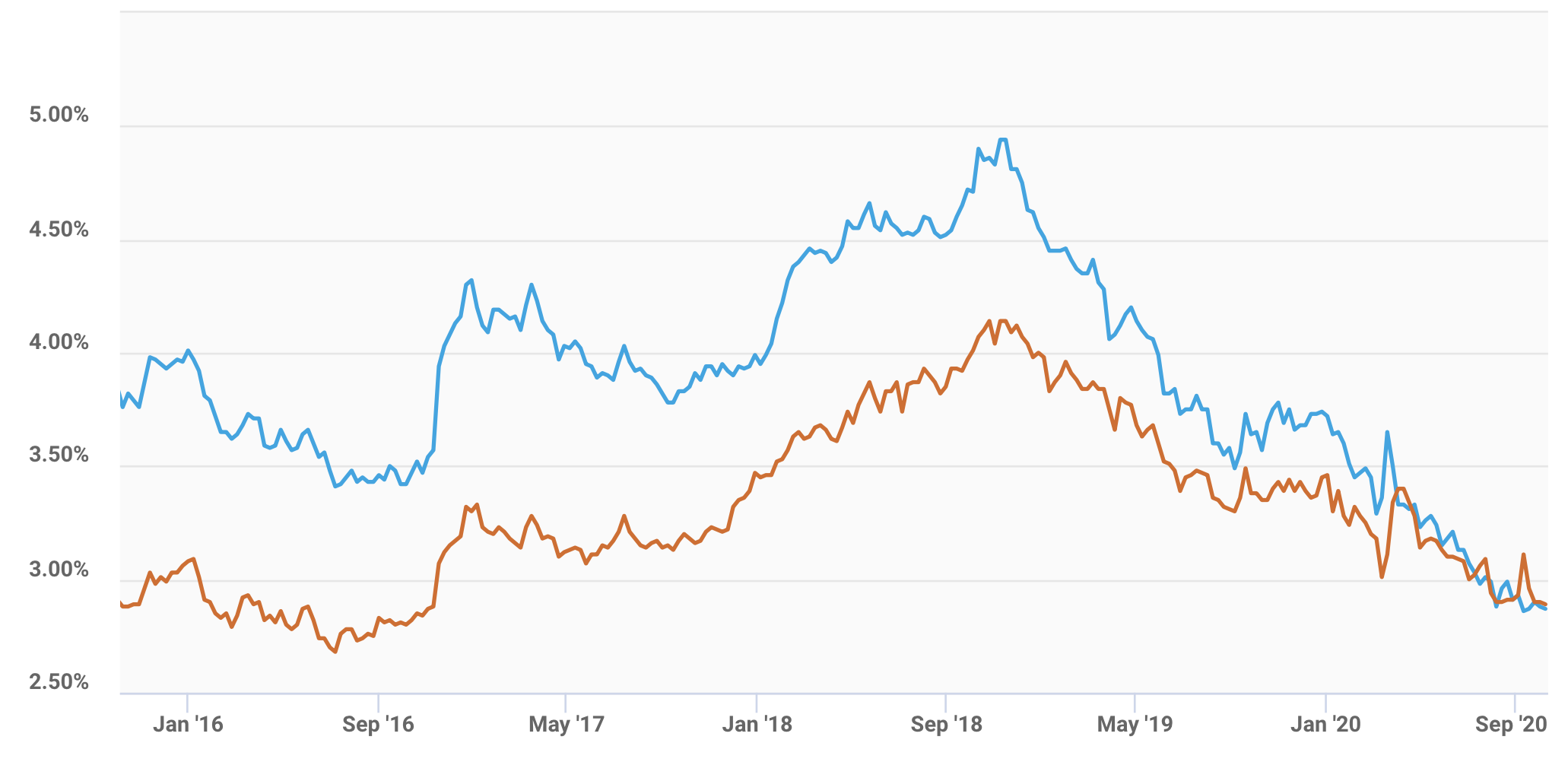

California Mortgage Rates Trends 30year Fixed Better Than ARM Loan?

Arm's Length Interest Rate Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). How does the ‘arm’s length’ test work in intercompany lending? In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. Intercompany lending arrangements within multinational. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). An arm's length transaction is a business deal that involves parties who act independently of one another.

From www.interest.com

Best 7/1 ARM Rates of 2020 Arm's Length Interest Rate When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). Intercompany lending arrangements within multinational. An arm's length transaction is a business deal that involves parties who act independently of one. Arm's Length Interest Rate.

From bpfund.com

California Mortgage Rates Trends 30year Fixed Better Than ARM Loan? Arm's Length Interest Rate An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. An arm's length transaction is a business deal that involves parties who act independently of one another. When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. Intercompany. Arm's Length Interest Rate.

From www.homebuyinginstitute.com

Types of ARM Loan Rate Caps Initial, Subsequent and Lifetime Arm's Length Interest Rate When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. An arm’s length transaction, also known as the arm’s length principle (alp), indicates. Arm's Length Interest Rate.

From kpmg.com

Serbia Rulebook on arm’s length interest rates KPMG United States Arm's Length Interest Rate When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. How does the ‘arm’s length’ test work in intercompany lending? An arm's length transaction is a business deal that involves parties who act independently of one another. In general, an arm’s length interest is the rate of interest. Arm's Length Interest Rate.

From www.sfgate.com

ARM rates SFGate Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? Intercompany lending arrangements within multinational. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. An arm's length transaction is a business deal that involves parties who act independently of one another. When you apply the arm’s length principle, related. Arm's Length Interest Rate.

From kpmg.com

2017 "arm's length" interest rates adopted KPMG Serbia Arm's Length Interest Rate An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. When you apply the arm’s length principle, related party loans should be charged interest rates. Arm's Length Interest Rate.

From www.at-mia.my

Understanding Arm’s Length Interest Deduction Accountants Today Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). Intercompany lending arrangements within multinational. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. When you apply. Arm's Length Interest Rate.

From www.at-mia.my

Understanding Arm’s Length Interest Deduction Accountants Today Arm's Length Interest Rate An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. How does the ‘arm’s length’ test work in intercompany lending? Intercompany lending arrangements within multinational. An arm's length. Arm's Length Interest Rate.

From www.youtube.com

ARM Vs Fixed Rate Mortgage Full Guide For Homebuyers YouTube Arm's Length Interest Rate In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. Intercompany lending arrangements within multinational. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. How does the ‘arm’s length’ test work in intercompany lending?. Arm's Length Interest Rate.

From www2.deloitte.com

Rulebook on “arm’s length” interest rates on loans for 2021 Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? Intercompany lending arrangements within multinational. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in.. Arm's Length Interest Rate.

From www.interest.com

Best 10/1 ARM Rates of 2020 Arm's Length Interest Rate Intercompany lending arrangements within multinational. An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. How does the ‘arm’s length’ test work in intercompany lending? Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). An arm's length transaction is a business deal. Arm's Length Interest Rate.

From karengustin.com

5 Year ARM Mortgage Rate History In Charts Karen Gustin Mortgage Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. In general, an arm’s length interest is the rate of interest. Arm's Length Interest Rate.

From www.youtube.com

5/1 ARM loan Adjustable rate mortgage YouTube Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. Intercompany lending arrangements within multinational. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent.. Arm's Length Interest Rate.

From www.redfin.com

Savings on AdjustableRate Mortgages Hit Highest Since at Least 2015 Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? Intercompany lending arrangements within multinational. When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). In general, an arm’s length interest. Arm's Length Interest Rate.

From kpmg.com

Arm's length interest rate for 2023 KPMG Montenegro Arm's Length Interest Rate When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates. Arm's Length Interest Rate.

From www.mortgagecalculator.org

10/6 ARM Calculator 10Year Hybrid Adjustable Rate Mortgage Calculator Arm's Length Interest Rate An arm's length transaction is a business deal that involves parties who act independently of one another. Intercompany lending arrangements within multinational. In general, an arm’s length interest is the rate of interest that would have been charged, at the time of debt formation, in an independent. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates. Arm's Length Interest Rate.

From bridgeportbenedumfestival.com

Historical Home Loan Interest Rates Australia HOME SWEET HOME Arm's Length Interest Rate How does the ‘arm’s length’ test work in intercompany lending? When you apply the arm’s length principle, related party loans should be charged interest rates that reflect the rates charged between unrelated. Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). An arm’s length transaction, also known as the arm’s length principle. Arm's Length Interest Rate.

From www.firstmeridianmortgage.com

Conventional 30 Year Fixed Mortgage Loan Adjustable Rate Mortgage VA Arm's Length Interest Rate Ministry of finance (“mf”) has adopted the rulebook on arm’s length interest rates for 2024 (“the rulebook”). An arm’s length transaction, also known as the arm’s length principle (alp), indicates a transaction between two independent parties in. Intercompany lending arrangements within multinational. An arm's length transaction is a business deal that involves parties who act independently of one another. When. Arm's Length Interest Rate.